The article below, titled Has Western Europe Become Free Of Political Risk For MNCs?, was written by Athanasia Kokkinogeni of Frontier Strategy Group, who graciously allowed Globig to share her entire article. The original article was posted on the Frontier Strategy Group Blog. We’d like to extend a special thanks to Athanasia Kokkinogeni and Frontier Strategy Group for their expertise and generosity.

2017 was supposed to be the year of political risk in Western Europe. A series of key political events – elections in the Netherlands, France, Germany, and potentially Italy, as well as Brexit – had created a surge of sensationalism in the media over the past year related to unprecedented political risk. Scenarios of a collapse of the European Union and a full-blown banking crisis shaped a pessimistic outlook for the region for 2017. Firms operating in Western Europe were increasingly concerned about the impact of potential populist victories to their business.

However, in line with FSG expectations, these risks have proven to be far overblown. Populists in the Netherlands and France were defeated by pro-business candidates while the far-right party in Germany has seen its support dwindle, setting the baseline for an upside for the region. Evidently, Trump’s victory weakened the support for populist parties, and voters become more skeptical of populist candidates and policies. The positive effects from pro-business candidates’ election has spilled over into the economic realm as we have seen a continuous appreciation of the euro against the dollar – from 0.95 in January to 0.89 in June – and strengthening economic sentiment.

The pro-business liberal Mark Rutte’s People’s Party for Freedom and Democracy (VVD) defeated extreme far-right Geert Wilders’ Party for Freedom (PVV) on March 15, mitigating the threat Wilders’ party posed to the EU. Coalition talks are still ongoing in the Netherlands, but are unlikely to impact the solid 1.6% YOY growth path for the market supported by stronger manufacturing and solid consumer demand.

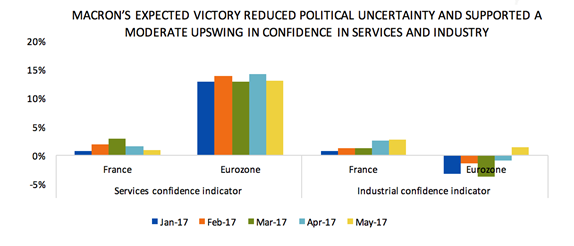

Contrary to public belief, the pro-business moderate reformist Emmanuel Macron defeated far-right populist Marine Le Pen on May 7, massively reducing political uncertainty for the region. Notably, the election of Macron is the best possible outcome for France and the Eurozone, as he is supporter of necessary pro-growth liberal reforms along with a socialist-type stimulus package for the next five years. In view of his re-election, both services and industrial confidence in France and the eurozone have strengthened. Fundamentally, in the likely case Macron’s La République En Marche! secures a majority in the parliamentary elections on June 18, a further improvement in sentiment and confidence in the French market and across the eurozone is likely thanks to the potential for a renewed reform momentum in France.

Still, the populist support we saw in H1 in the Netherlands and France shouldn’t be neglected; in case these pro-business candidates fail to deliver on pre-election commitments, populists will be on track to win in the next elections in 2022, and the new populist movement can easily gain momentum going forward.

Looking ahead, Chancellor Angela Merkel’s re-election was the central political risk factor for H2, though here too concerns have diminished. Chancellor Merkel has increased her chances – 90% – of re-election on September 24, despite a historically stronger Alternative for Germany (AfD). AfD had been strengthening in light of terrorist attacks in 2015 and especially 2016, in part because of Merkel’s welcoming migrant policy, yet her more recent policies have helped weakened the AfD. Merkel has shifted towards a harder line on migration and restricting the movement of illegal migrants or migrants with a violence record. To Merkel’s advantage, migrant flows have slowed notably compared to 2015 and 2016 following the EU-Turkey refugee deal and less refugee outflows from the Middle East. This has curbed the AfD’s popularity, and the AfD has in turn moved to an even more far-right position ahead of the elections, as the party felt they are losing support and thus they altered their leadership.

Although the banking sector remains the eurozone’s Achilles’ heel, the bank lending outlook is slowly improving, and FSG revised down the likelihood of a banking crisis to 5-10%. The improved bank lending has strongly benefited from the reduced political risk and gradual improvement in market conditions. Positive outcomes in eurozone elections matched with an only minimal Brexit impact to the weak eurozone banks removed threats to the solid growth seen in key markets like Germany, United Kingdom, France and Spain. Additionally, eurozone non-performing loans are on the decline (albeit at a slow pace) in the risk high markets of Italy, Greece, Cyprus, Ireland and Portugal, and gradual bank recapitalizations have helped strengthen their weakest banks. Furthermore, the deal with Greece and creditors prevented a downside for the region in which Greece would leave the eurozone.

Although all these steps are in the right direction and in line with FSG expectations, still a lot of questions remain specifically for Italy. Its muted outlook, weak banking sector, and ongoing political uncertainty still frame Italy as a risk in H2. Stay tuned for our next blog addressing the outlook for Italy later in the month.